Health & Fitness club technology systems -

designed to add value to your business

Silatec.com is at the forefront of providing club and business operatives and small business owners with effective IT systems, designed to deliver genuine operational results.

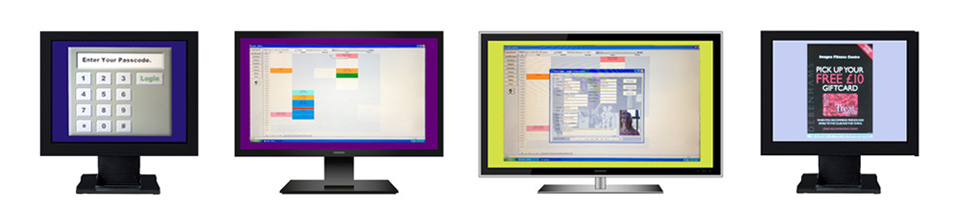

Offering you the Ryburn Club Manager; Logger; Diary and Database systems (shown above), amongst other emerging technologies, Silatec.com has over 20 years of proven experience, specialising in the health and fitness sector. We are passionate about business and fitness and are dedicated to helping our clients harness the latest IT developments – increasing their business's performance.

Want to do more work in less time?

Silatec.com will unlock the power of your existing technology, or advise you on the best solutions to increase your productivity. Working with you, we can develop bespoke software solutions based on your individual requirements and we're confident we'll find a solution that saves you time and money!

We offer small business owners the following services and more:

• Bespoke technology packages including cloud and hybrid solutions

• Domain purchasing and management

• Web domain hosting

• Email services including full Microsoft Exchange installations

• On-site networking and server solutions

• Business

consultancy

• Database management packages

To find out more about Silatec.com and the ways in which we can help you, simply get in touch today. We look forward to being of service to you and your business.

“Our total emphasis and dedication is to improve business profitability through the use of proven business systems and effective, efficient management techniques. We don’t just advise we get on with it!”

Experienced club business services with over 20 years experience

Find out how we can help you...

Email info@silatec.com

© 2021 Silatec.com Ltd, 1 Airport West, Yeadon, Leeds LS19 7ZA. Silatec.com is authorised and regulated by the Financial Conduct Authority | Privacy Policy